December 19, 2019

- All

- 5G

- AI

- Android

- Augmented Reality

- Big Data

- Business

- Claim Construction

- Cloud

- cloud to cable

- CloudTV

- Crypto

- Damages Expert

- Damages Report

- Daubert Challenge

- Edwin

- EGLA

- EGLA MEDIA PLATFORM

- EGLAVATOR

- Entrepreneurship

- Expert Witness

- FinTech

- Hacking

- Hadoop

- Health Technologies

- Intellectual Property

- Inventions

- IOT

- IPR

- IPTV

- J2ME

- Legal

- Linux

- Litigation

- LTE

- Machine Learning

- Media Projects

- Mediamplify

- Mevia

- Mobile Development

- Mobile Device

- Mobile World Congress

- Mobility

- Music for Cable TV

- Neural Networks

- Open CV

- Patents

- Products

- PTAB

- Simulation

- Smartphone

- software

- Startups

- Tokens

- USPTO

- Venture Fimdomg

- Wireless

November 24, 2019

Introduction I will start quoting, MultiChannel article that describes the genesis of this dispute.. Stingray and Music Choice have a long history. In 2015, Music Choice […]

November 12, 2019

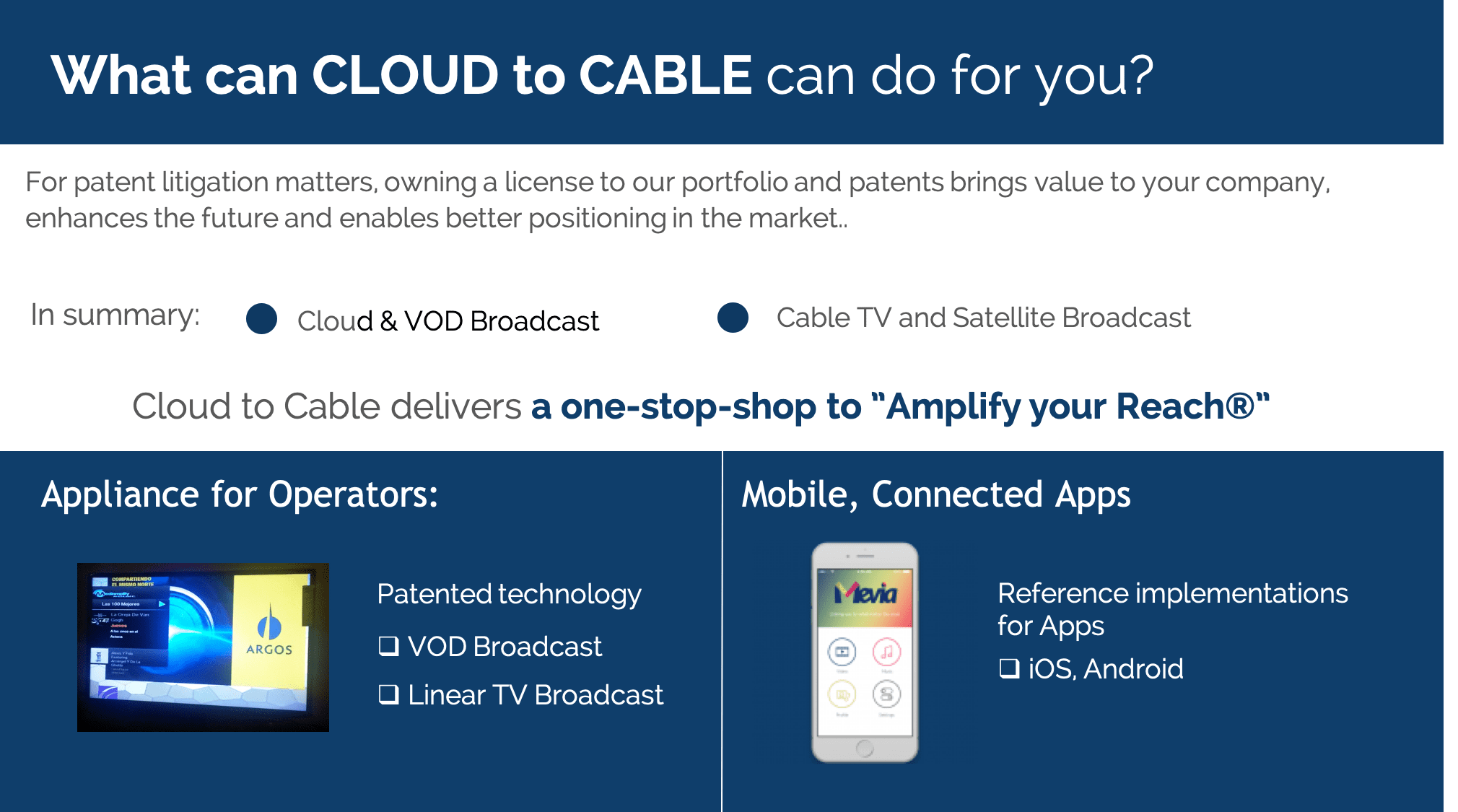

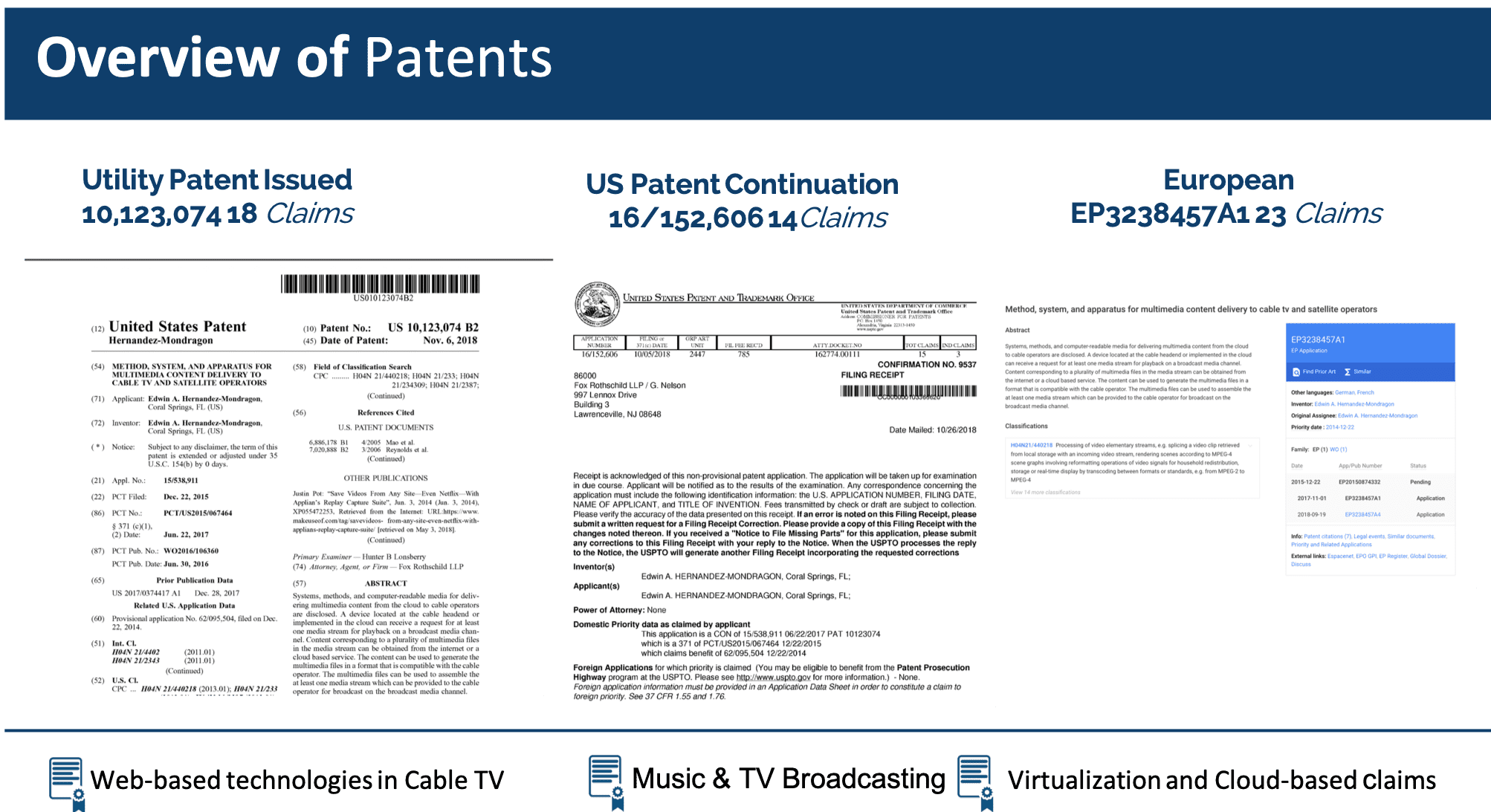

Why Cloud to Cable? Cloud to Cable is a patented solution for music streaming providers to distribute content to MVPDs. Amplify your offering from online streaming […]

November 30, 2018

Cloud to Cable TV is the platform that makes it easy to send music channels, video channels, video on demand, and any other multimedia streaming content […]

June 30, 2018

What is Cloud to Cable TV? Use Case : Music for Cable | Amplify your Reach® First Patent is Allowed and will be granted The patent […]